Step up your KYC game

How can we help?

In recent years, fintechs have achieved considerable success due to their ability to launch quickly, and scale and adapt seamlessly and more cost-effectively.

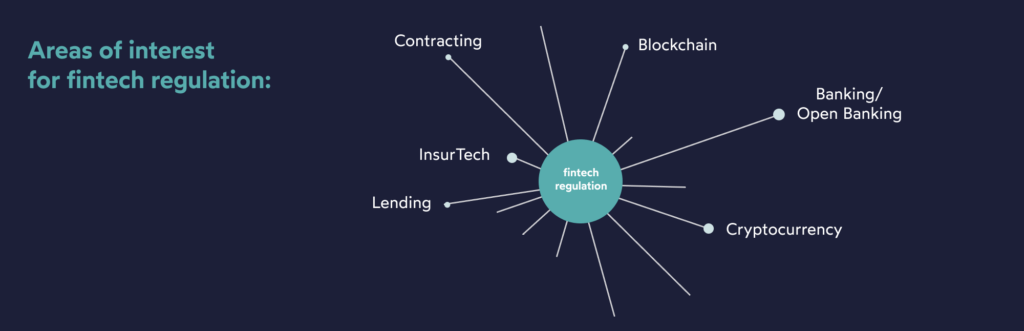

This rapid growth comes with its own regulatory challenges, though. Smaller fintechs now face similar regulations as to large financial institutions, and must therefore stay aware of fast–changing regulations across many different areas of operation.

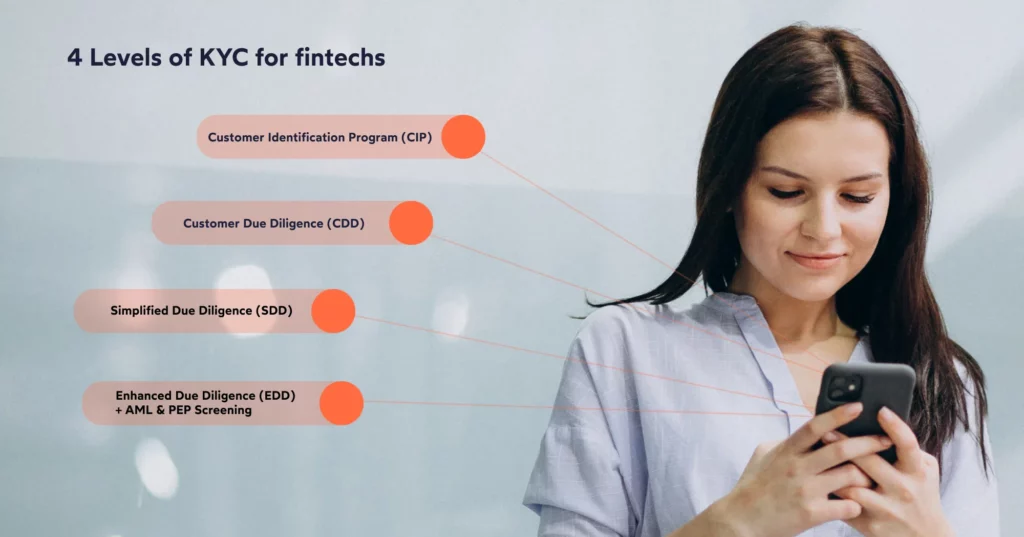

With increasingly complex regulations and the ever-present risk of fraud, a speedy and secure identity verification service can supercharge your fintech business and streamline operations. Offer your customers the onboarding and user experience they deserve with our fully customizable platform for identity proofing.