What is Money Laundering?

Money laundering is the illegal process of hiding the origins of money obtained illegally by passing it through a complex system of banking transfers or other transactions. The process of acquiring money illegally and turning it into clean, legal tender has typically three main stages.

- Placement

- Layering

- Integration

In reality, these stages may overlap or be repeated.

Money Laundering is often carried out by Money Mules or owners of e.g. bank accounts who are more or less unconsciously involved in Social Engineering.

More info in our latest blog article: Understanding ‘Money Mules’ – an interview with IDnow fraud specialists

Governments all over the world have stepped up their efforts to fight money laundering, with AML actions that require financial institutions to put systems in place to detect and report all suspicious activity.

Money laundering involves disguising the origins of illegally obtained proceeds so that they appear to be legitimate – “laundering” them from dirty to clean, in other words. It is often associated with activities such as arms sales and smuggling, or corporate crime such as insider trading, bribery, or embezzlement. There is also a strong link with terrorist financing.

Money laundering remains a widespread problem globally. The overall level of activity is hard to measure – but according to the United Nations, it accounts for 2% to 5% of global GDP (around US$800 billion to US$2 trillion). In the UK, the National Crime Agency records over £100 billion of laundered money affecting the UK economy annually.

What is placement in money laundering?

Placement refers to placing the illegally obtained "dirty "money into the financial system. Funds are moved from their source into a legitimate financial system.

What is layering in money laundering?

The second stage involves creating a complex network of transactions and records for the movement of money. This often involves offshore techniques. Doing this will obscure the sources and the audit trail and make it more difficult for authorities to detect.

What is integration in money laundering?

Finally, the money is absorbed or integrated into the economy. This now legal tender is reunited with its original owner in what appears to be a legal holding.

How does money laundering work?

Money laundering can be extremely complex, involving multiple individuals and transactions. There are a variety of ways to launder money, but all typically involve moving the money through a series of complex financial transactions in order to make it appear to come from a legitimate source. Money launderers often use techniques such as shell companies, offshore accounts, and money transfer services to conceal the money's true origins. This process makes it difficult to trace the money back to its criminal origins.

Once the money has been successfully laundered, it can be used for a variety of purposes, including funding criminal enterprises, terrorist activities, and personal expenditures.

Based around the three stages of placement, layering and integration, the process can involve the following:

- Placement involves many different methods to introduce money into a legitimate financial system. These include blending with legitimate funds from legal sources, invoice fraud (typically involving over-invoicing or phantom services), breaking funds into smaller amounts with multiple accounts or transactions, and physical carriage of cash across borders.

- Layering techniques to disguise any trail include conversion between money and stocks or other financial instruments, moving money between countries, and investments in shell companies.

- The final integration stage often involves investing the money into areas such as property, jewelry, or high-priced commodities. False invoicing may be used to over-value goods.

What are money laundering techniques?

Money laundering can be achieved through several methods, including

- smurfing

- cuckoo smurfing

- chip dumping in online poker

- bank drop

- front companies

- money transfer schemes.

Smurfing is a common money laundering technique in which large sums of money are divided into smaller amounts and deposited into multiple bank accounts. This makes it more difficult to trace the money back to its criminal origins.

Additionally, front companies are often used to launder money by setting up bogus businesses and funneling money through them.

A third example is through money transfer schemes which involve using wire transfers or other means to move money around the world, making it difficult to track.

These are just a few examples of how money laundering can be accomplished. There are many variants of money laundering, and new methods are constantly being developed. With ever-evolving technology, it is becoming increasingly difficult to detect and prevent money laundering on a global scale.

Big sports events such as the FIFA World Cup can be attractive targets for money launderers, who may use online gaming platforms to hide or transfer funds obtained through criminal activities. The large amounts of transactions during these times make it more difficult for operators to detect suspicious behavior, making them vulnerable to exploitation by criminals looking to launder their money. It is essential that operators have adequate anti-money laundering systems in place and implement rigorous checks on all customer accounts.

What are common examples of money laundering?

Here are some typical examples of money laundering that can occur online:

1. Online Auctions:

A money launderer might create multiple accounts on an online auction platform. They then list items for sale, but instead of completing actual transactions, they use these listings to move illicit funds between accounts. The appearance of legitimate sales activity helps disguise the illegal origin of the funds.

2. Digital Currency Mixing:

Money launderers can use specialized online services called "mixers" or "tumblers" to obscure the source of their cryptocurrency funds. These services mix various transactions together, making it difficult to trace the original source of the funds, effectively "cleaning" the money.

3. Online Casinos and Gambling Sites:

As previously mentioned, online casinos and gambling sites can be used to layer illicit funds. Money launderers may intentionally lose and win bets to create a complex transaction history that confuses the trail of funds.

4. E-commerce Platforms:

Criminals may use fraudulent online storefronts to move illegal funds. They create fake online shops, then use stolen credit card information to make purchases from themselves. This gives the appearance of legitimate sales and transfers funds in a circuitous manner.

5. Virtual Goods Trading:

In online gaming environments, virtual goods like skins, weapons, or in-game currency can be bought and sold. Money launderers might exploit this by purchasing virtual goods with illicit funds and then selling them for clean funds, effectively legitimizing the money in the process.

6. Peer-to-Peer Payment Platforms:

Some criminals use peer-to-peer payment platforms to move funds between accounts. They may engage in fictitious transactions with multiple accounts to obscure the trail of funds and make the transactions appear legitimate.

7. Online Investment Scams:

Fraudulent online investment schemes promise high returns and encourage victims to invest their money. In reality, the funds are funneled through a series of transactions to make them difficult to trace, and the promised returns never materialize.

8. Online Charities and Crowdfunding:

Criminals might set up fake charitable organizations or crowdfunding campaigns to collect funds from unsuspecting donors. These funds can be laundered through a series of transactions, making it challenging to determine their criminal origin.

9. Offshore Online Banking:

Some individuals use online banking services in offshore jurisdictions with lax regulations to move and store illicit funds. These services provide anonymity and make it difficult for authorities to trace the origin of the funds.

10. Cryptocurrency Initial Coin Offerings (ICOs):

Fraudulent ICOs can be used to launder money. Criminals might create a fake cryptocurrency and sell tokens to unwitting investors, effectively converting illicit funds into seemingly legitimate digital assets.

These examples highlight the creative ways criminals can exploit the online environment to launder money. However, law enforcement agencies and financial institutions are constantly improving their methods to detect and prevent these activities through stricter regulations, advanced monitoring technologies, and international cooperation.

How do you prevent money laundering?

Money laundering is a serious crime that can have devastating effects on both individuals and businesses. However, there are a number of ways to prevent money laundering, through anti-money laundering laws, which were first set through the creation of the Financial Action Task Force.

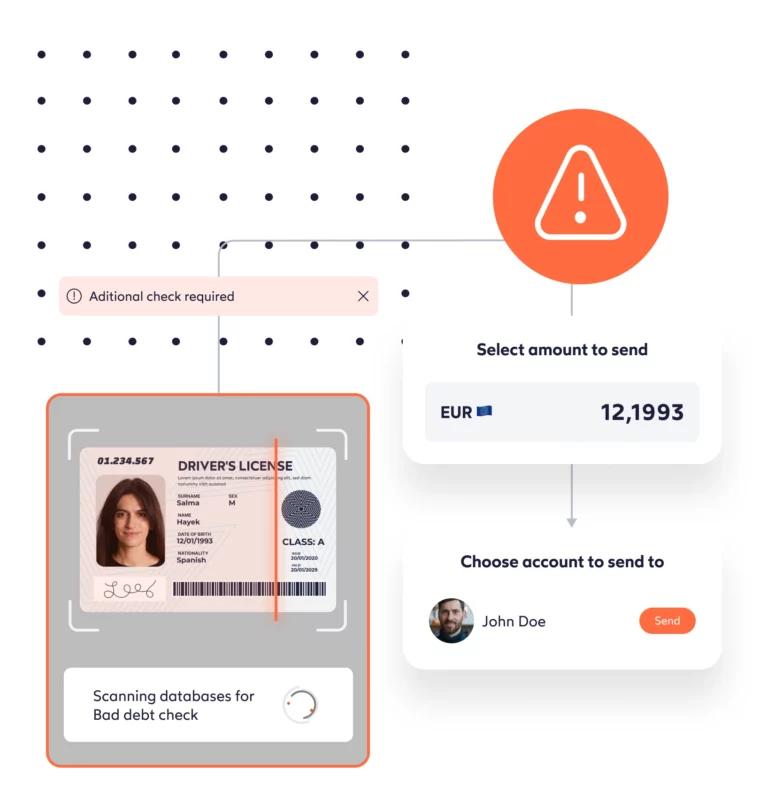

Preventative measures can include Know Your Customer (KYC) policies, compliance programs, and Suspicious Activity Reports (SARs).

KYC policies require businesses to verify the identity of their customers and keep track of their financial activity. Compliance programs help businesses to identify and report suspicious activity, and SARs are filed with law enforcement when a business suspects that money laundering is taking place.

Read our ‘Red flags unraveled: How to detect money laundering’ blog to discover six money laundering red flags to watch out for.

In addition, money laundering can also be combatted by freezing and confiscating assets, as well as by prosecuting those who engage in it.

By following these preventative measures, businesses can help to combat money laundering.

It's important to note that authorities and financial institutions are actively working to prevent such activities by implementing stringent regulations and anti-money laundering (AML) measures, especially within the crypto and financial sectors. Cryptocurrency exchanges, online gambling platforms, and financial institutions are obligated to conduct thorough due diligence and report any suspicious transactions to relevant authorities.

ID Fraud Report 2022—Identities in a digital-first world