What is BaFin?

The Federal Financial Supervisory Authority, better known as BaFin, is the financial supervisory authority for Germany. It is an independent federal institution that reports to the Federal Ministry of Finance. BaFin ensures that citizens in Germany can have confidence in the financial system.

What does BaFin do and who does it supervise?

The Federal Financial Supervisory Authority (BaFin) is the competent authority that controls and supervises the financial market in Germany. It is an institution under public law and has its headquarters in Bonn and Frankfurt am Main. BaFin reports to the Ministry of Finance, and the Federal Government appoints its president. In general, BaFin is supposed to ensure that the financial industry remains stable and thus protect consumers from crises. Furthermore, the BaFin is entrusted to "prevent the misuse of the financial system for the purpose of money laundering, terrorist financing and other criminal offences, which can lead to a threat to assets of an institute."

BaFin's main task is to supervise the financial sector, i.e. banks, insurance companies and securities trading. It issues licences to banks and examines their transactions. This is to protect consumers and ensure that banks manage the assets transferred to them in a trustworthy manner. For this purpose, BaFin gains insight into the banks' balance sheets. In this way, BaFin checks compliance and can impose far-reaching sanctions in the event of violations. These range from written warnings and fines to the withdrawal of the banking licence and the closure of credit institutions.

A similar situation applies to the supervision of the insurance industry. New insurance providers need a licence from BaFin. Among other things, BaFin checks whether insurance companies have sufficient equity to fulfil their contracts, i.e. whether insured persons can be safely compensated in the event of a claim.

In securities trading, the Federal Financial Supervisory Authority analyses share prices for anomalies and ensures that share prices are not manipulated. Share trading is to be based purely on the principle of supply and demand. BaFin detects any influence on prices and intervenes if necessary.

What requirements does BaFin check for the prevention of money laundering?

The prevention of money laundering is also within BaFin's remit. In terms of BaFin's main task, money laundering can lead to the destabilisation of the financial system if, for example, credit institutions are misused for such activities. For this reason, BaFin makes specifications that are intended to serve transparency in the financial market and to make business relationships and transactions comprehensible and low-risk. Certain duties of due diligence apply, which are laid down in the Money Laundering Act (GwG) and compliance with which is checked by the authority. The due diligence obligations include identifying contractual partners, obtaining background information on the purpose of the business relationship and checking whether the contractual partner belongs to the group of politically exposed persons (PEP). The identification of contractual partners must always be carried out before entering into the business relationship or concluding the transaction.

Who may identify under the MLA?

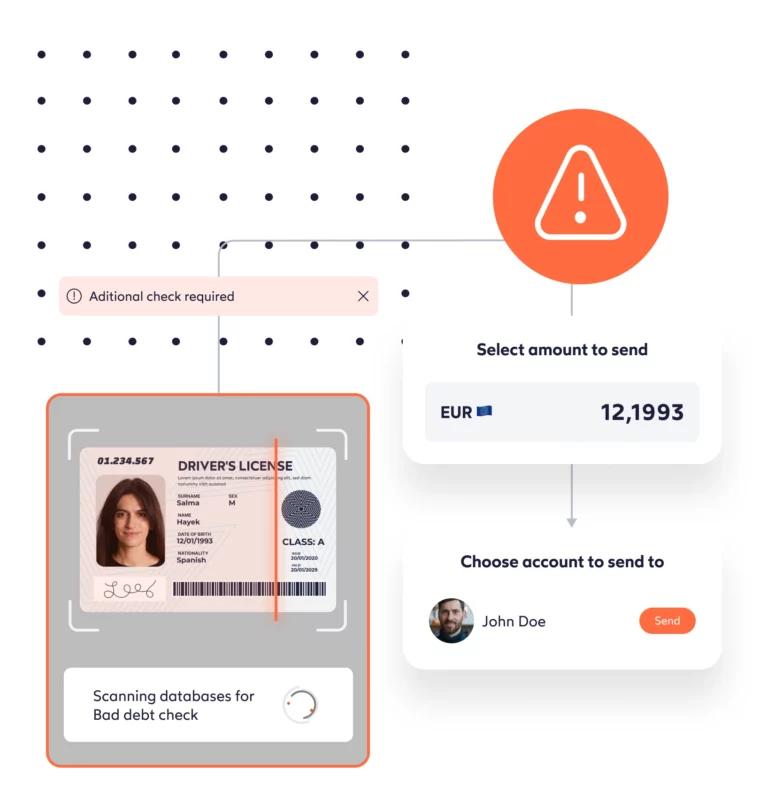

In principle, the contractual partners can carry out the identification themselves. In order to ensure that BaFin requirements for KYC are implemented in a legally secure manner and compliance violations are prevented, identification providers provide AMLA-compliant solutions. For example, IDnow AutoIdent can be supplemented with an add-on for anti-money laundering screening. After the regular, automated verification of the contract partner's identity, the data can be compared with lists of politically exposed persons and sanctions lists and optionally checked for negative media coverage.

When does the identification obligation apply?

In principle, the requirements of the MLA must be fulfilled by all so-called obligated parties. These include, for example, banks, lawyers, financial service providers, gambling providers and real estate agents. In general, each contracting party must be identified prior to a business relationship or transaction. Thus, for example, banks have to verify each customer before opening an account and each gambling provider has to identify its users upon registration. First and last name, address, date and place of birth, nationality, ID number and type of ID as well as the issuing authority must be recorded. In the case of previous clients and if the data has already been recorded, a new identification may be waived.

BaFin checks this identification according to the AMLA and periodically issues interpretation and application notes (Auslegungs- und Anwendungshinweise, AuA) on the Money Laundering Act. They are intended to support companies from the financial sector and other obligated parties in fulfilling their due diligence obligations. The AMLA stipulates that the BaFin's AuA apply to all obligated parties under its supervisory obligation, i.e. in particular credit institutions, financial service providers and insurance companies.

If anomalies occur with contractual partners, a reporting obligation applies. However, the Federal Financial Supervisory Authority is not responsible for this; it does not accept reports of individual cases. Facts that give indications of money laundering activities are to be reported to the Central Office for Financial Transaction Investigations.

Read also more on the Anti-Money Laundering Authority of the European Union.