The proliferation of digital products and services has had many effects, one of which is the desire for quick and easy identity verification methods.

The internet penetration rate in the United Kingdom is at an all-time high.

Britons now spend an average of 3.5 hours every day on the internet — the statistic is much higher for Britons who work and live through e-commerce establishments.

The unstoppable rise of the internet opens up a plethora of questions that technology providers need to answer. The most important revolve around ways of building security and trust, without frustrating end users.

How do we keep every Briton safe and secure when they access the internet — without hampering user experience?

On-demand culture in the UK.

The proliferation of digital products and services for the everyday consumer has had many effects — some intended, others unforeseen.

As is customary when people have multiple choices, an unpleasant one-time experience is enough to negatively affect customer experience, leading them to switch between brands that provide more pleasurable experiences. This is the most important rule guiding a frequently increasing on-demand culture in the UK.

What is on-demand culture?

The term “on-demand culture” pays homage to a 21st-century consumer trend of heightened consumer convenience.

A major example of on-demand culture in action is the expectations of mobile phone users. For mobile devices, users want digital service providers to deliver top-notch services and software solutions — search engines, financial apps, instant messaging — that can work securely and efficiently anywhere in record time.

In line with the on-demand culture in the United Kingdom, end-users require the most of digital ID verification systems. Consumers want an identity verification system that is fast, reliable, and accessible on cue.

How to be ‘on-demand’ compliant.

Given that 85% of internet users in the United Kingdom would rather access the internet via a smartphone, digital ID systems that are accessible on both web and mobile platforms will be considered on-demand compliant.

Consumers will waste no time switching brands whose ID systems they consider to be unavailable or often inaccessible. Tech service providers need to always prioritise solutions that fit the on-demand culture. Digital identification solutions, no matter how complex the backend operations, are no exception.

Ultimately, Digital ID solutions that fall short of the on-demand culture expectations risk losing consumers, who will undoubtedly lay claim to poor customer experience.

As of the turn of 2021, an aggregate of 939 million contactless transactions have been made in the United Kingdom. As more people decide to function digitally, there’s a corresponding increased responsibility on the part of public and private stakeholders to ensure that the internet is safe, secure and trustworthy.

What is digital identity verification?

Digital identity verification is fast becoming a requisite for smooth operations in the on-demand digital economy — and the digital world. Digital ID verification systems provide processes to digitally authenticate a person’s identity whenever the need arises. For digital ID verification systems to work, people need to have their own individual digital identities.

The global power of digital IDs.

The United Nations recognizes the need to bring trust back to digital operations. Together with the World Bank’s ID4D initiative, the plan is to provide every person on earth with a legal identity by 2030.

Providing security for consumers through digital ID verification is crucial for all digital service providers who want to stay ahead of the curve. As part of the on-demand culture amongst Britons, businesses that do not provide a robust digital ID framework for their customers are very likely to lose out.

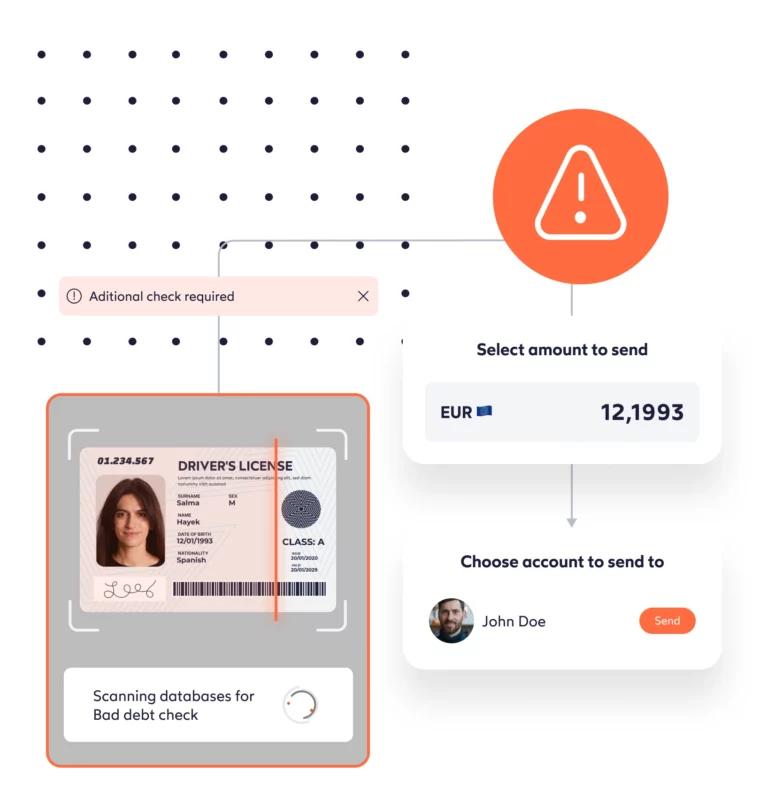

Nipping the “fraud” bud.

Fraud, money laundering and a swathe of financial crimes are what you get in a world where digital ID is not taken seriously by both private and public stakeholders.

The United Kingdom, according to research findings by Uswitch, was the highest-ranked nation in Europe for money lost by online fraud in 2020. A mind-boggling amount of 376.5 million pounds was lost to e-commerce fraud.

There’s still a lot more to lose to fraud because the threat still exists. For the end-users, especially on digital payment service platforms, the threat of fraud is a big-enough incentive to switch to more reliable and secure solutions.

Digital ID solutions that are accessible, operable and usable by Britons anywhere will surely change the racecourse, favourably. A workable digital ID process should combine national identity documents with company-specific consumer data (biometrics, to facilitate on-demand electronic identification) for every financial transaction.

This effectively prevents fraud and other financial crime cases to create the kind of secure environment that ultimately ensures Britons trust in the digital economy.

Identity crisis? The future of digital IDs in the UK.

The UK government’s stance on digital IDs.

The United Kingdom government has not had the best of times where implementing a national digital identity project is concerned. The cost-intensive “Verify” digital identity project fell short of its goals — meaning the UK does not yet have a national standard identity verification system. Read more about the UK’s troubled relationship with digital IDs in our ‘Why the UK banking sector and FCA are banking on digital IDs in 2023’ blog.

Nonetheless, the British government is still keenly aware that digital ID systems are the key to a future of financial inclusion and security in the United Kingdom. It is precisely why the Government Digital Service is working on another digital identity project.

Following further amendments to financial regulations, the government’s position — under the trust framework — is to make it mandatory for service providers to have effective, robust, flexible and scale identification verification systems. For service providers, nothing should be more important than picking the right identification verification service to work with.

A user-centric digital ID system.

Building a hugely secure digital ID system is important. That said, building one that is not just simple, but also requires minimal effort to operate is far more important — because it really is all about the end-user.

In line with the on-demand culture in the UK, companies need identity verification solutions that excel in: security, compliance and versatility.

Get in touch with IDnow.

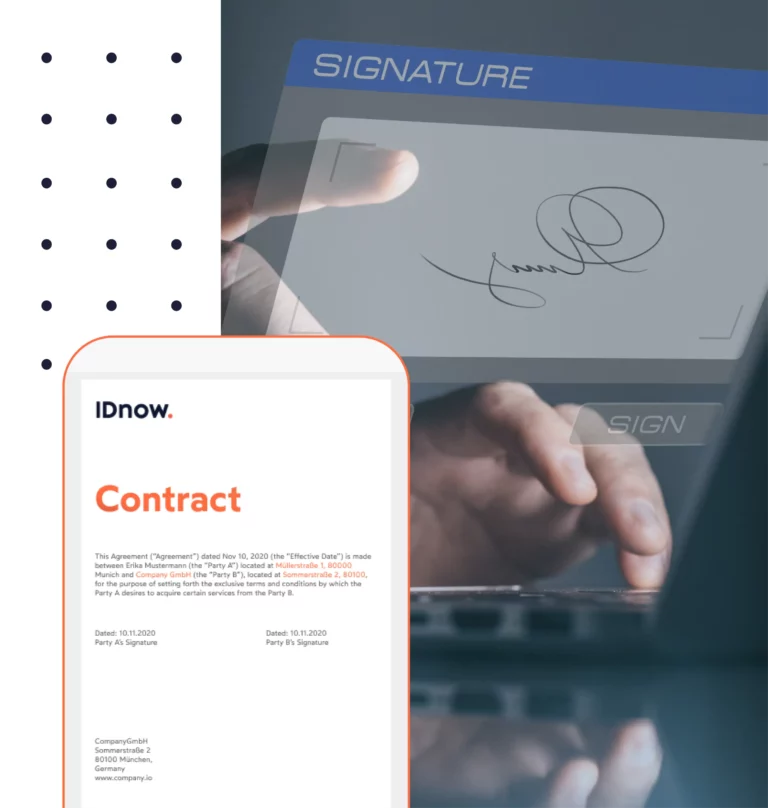

Simple and effective digital identity verification systems are not as straightforward as they sound. These systems require massive data input, immense technological capabilities and strict compliance with the government’s identity regulations.

Even for the most qualified tech service providers, forging a consumer-centric digital ID verification solution that complies with the on-demand culture can be a tough ask.

.And that’s where IDnow comes in.

IDnow is proudly in control of one of Europe’s leading identity verification platforms with trusted expertise in regulation markets, financial institutions and a host of other businesses and industries.

One glance at our website, and you’ll be under no illusion that fostering a positive customer experience while delivering value is something we’re great at. Here’s the link to our comprehensive Partnership Program for more information.

Partner with us now and get a digital ID verification solution that fits perfectly into today’s on-demand culture.

By

James Hudson-Dale

New Partner Sales at IDnow

Connect with James on LinkedIn