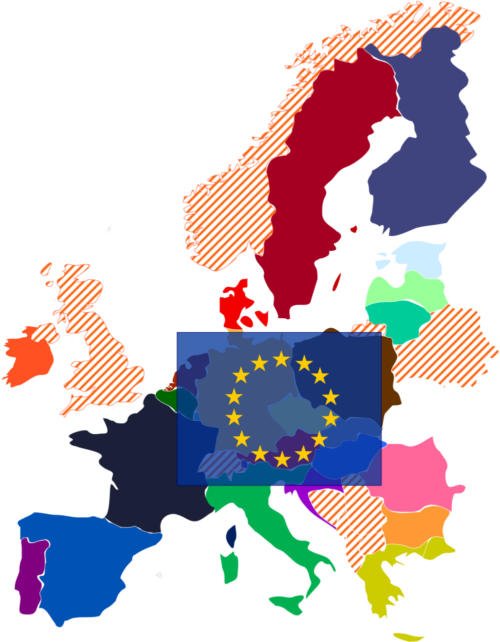

AML landscape

By July 10, 2027, the way financial institutions verify identities of their customers will fundamentally change. With the introduction of the EU’s new Anti-Money Laundering Regulation (AMLR) and the expansion of eIDAS 2, traditional identification methods will no longer be sufficient. These regulatory shifts will redefine compliance requirements across the EU, demanding new standards of assurance, interoperability and digital-first verification.

To stay ahead of these changes, bookmark this page – your single, continuously updated source for all AMLR and eIDAS 2 developments.

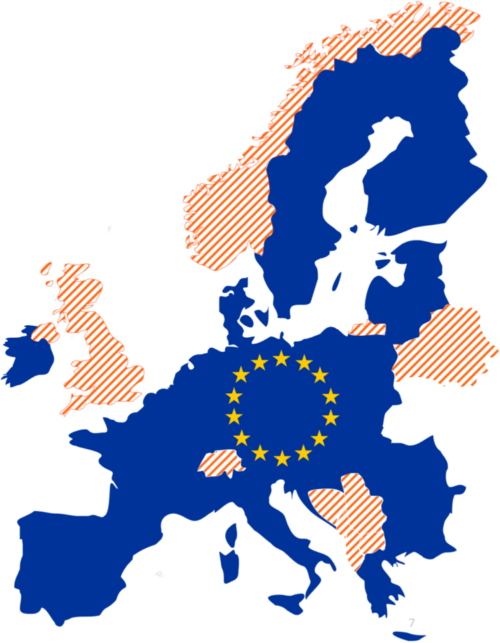

Contact usBy July 10, 2027, the EU will shift from standardized to fully harmonized AML regulations through AMLR and eIDAS 2, creating a single set of binding rules across all member states. This will eliminate national differences and enable secure, cross-border, AML-compliant digital identity verification.

Under the new AMLR and eIDAS 2 frameworks, country-specific certifications issued by national supervisory bodies will no longer be valid for identity verification. Instead, only EU-wide recognized methods, certified by ETSI, will be accepted.

The new AML regulation and ETSI standard specify only three identity verification methods that will be considered compliant going forward: national Electronic Identification (eID) schemes, the European Digital Identity (EUDI) Wallet and Qualified Trust Services (QTS). Trusted services for KYC will ensure that identification as customers know it continues – seamlessly and securely – under this new framework.

Under today’s model, banks handle identity verification using providers like IDnow. By July 10, 2027, this responsibility will shift under AMLR to regulated methods such as eID schemes, digital identity wallets, and Qualified Trust Services (QTS). However, IDnow’s core solutions of biometric and document verification will remain critical for enrolling users, issuing credentials, and managing higher-risk or cross-border checks. To support this transition, we’re launching the IDnow Identity & Trust Platform that provides access to all major eID schemes, and European Digital Wallets, and integrates with IDnow Trust Services, a certified QTSP.

Qualified Electronic Signatures (QES) and Qualified Electronic Attribute Attestations (QEAA) will be used for cross-border customer identification as part of trust services that ensure the security, integrity and authenticity of electronic transactions.