What is KYC & AML?

The Know Your Customer (KYC) process is performed to verify the identity of new customers, and to prevent illegal activities, such as money laundering or fraud. KYC is undertaken as part of Anti-Money Laundering (AML) requirements.

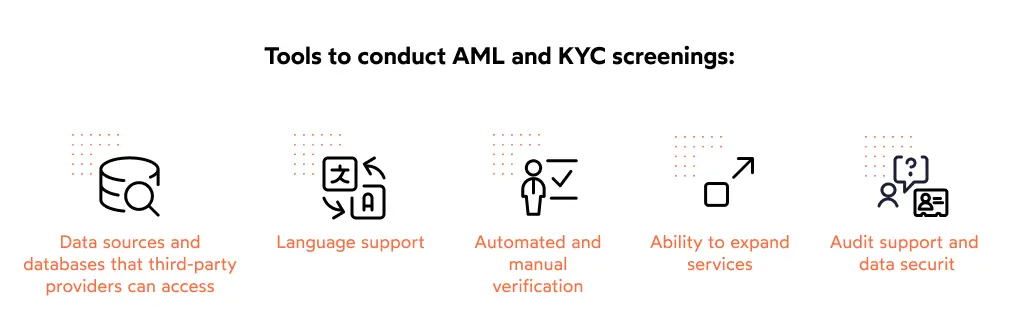

Conducting KYC and adhering to AML regulations protects both the company and its customers.