Financial Services • Ireland

With more than 170 branches across Ireland, Allied Irish Banks (AIB) is a leading financial institution, providing a comprehensive range of services, including personal and business banking, savings and investments and mortgage solutions.

1966 founded

10 600 employees

3.3 million customers (2.2M online users)

With IDnow since 2016

AIB slashes onboarding time by 66% with IDnow’s video solution

6 minutes read

AIB modernized its onboarding with IDnow, shifting from in-branch verification to a seamless, remote process. By integrating secure digital identity verification, AIB enhanced customer convenience, met regulatory requirements and scaled efficiently to support growing demand.

Partnership overview

AIB has been leveraging IDnow’s identity verification solutions since 2016 to streamline its digital onboarding processes. This partnership has enabled AIB to deliver secure and seamless experiences, even during periods of high demand. Together, AIB and IDnow share a vision of empowering customers with innovative, reliable and efficient banking services.

The challenge

Historically, AIB required all new customers to visit a branch for account opening, including identification and verification.

This process was not only time-consuming inconvenient, with customers often having to wait up to 6 weeks for an appointment, but also failed to meet the expectations of younger, digitally native customer base.

With over 2.19 million active digital users and a growing demand for remote services, AIB needed a solution that could automate the verification process and improve convenience, while not compromising on security. To remain competitive and meet regulatory requirements, AIB sought to develop a seamless, remote account opening capability, allowing them to retain and grow their share of the Irish current account market.

Technical objectives

To overcome these challenges, AIB identified several key technical requirements for the transformation of its onboarding process:

- Remote and secure onboarding: Implement a solution that ensures identity verification is both secure and compliant with regulatory standards while eliminating the need for in-branch visits.

- Seamless integration: Choose a solution that can integrate effortlessly with AIB’s existing mobile app.

- Scalability: Accommodate future scalability for increased onboarding volumes and extended product offerings.

By addressing these technical requirements, AIB aimed to deliver a frictionless digital onboarding experience, grow its competitive position in the Irish current account market, and exceed the expectations of its growing digital customer base.

Why IDnow?

AIB chose IDnow for several key reasons:

- Expertise: Expertise in remote, digital identity verification

With over a decade of proven experience in delivering secure and innovative digital identification solutions, IDnow has a deep understanding of regulatory compliance across the EU. - Flexibility: Flexibility to adapt to AIB's requirements.

With multiple integration capabilities and broad product portfolio, IDnow offers configuration flexibility to adapt to unique use cases. - Commitment: Commitment to being a partner, rather than a vendor.

With predefined KPIs and dedicated technical support that ensures ongoing optimization to meet AIB's evolving requirements.

The solution

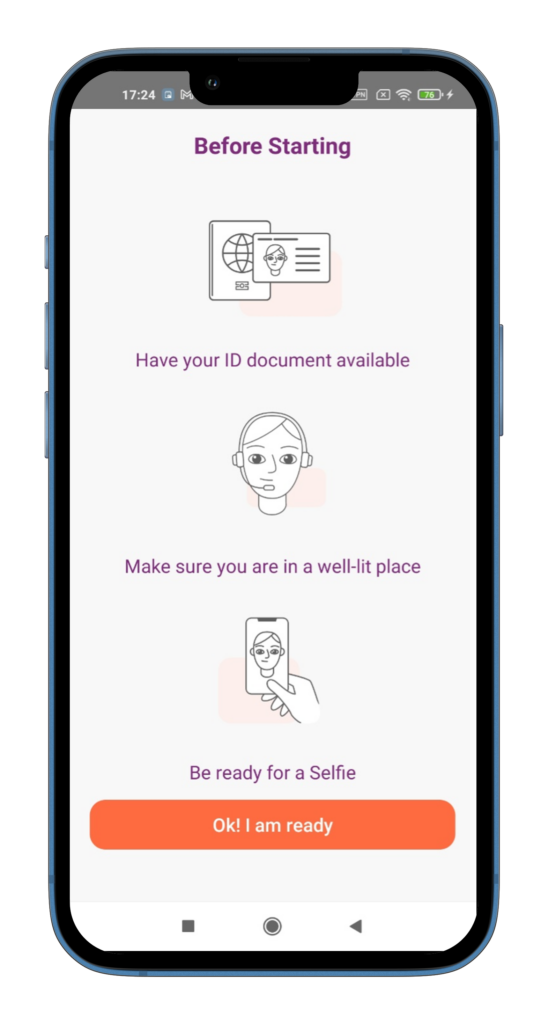

To ensure the highest standards of security and accessibility, IDnow partnered with AIB to create an innovative Remote Account Opening proposition, leveraging VideoIdent – IDnow's expert-led video verification solution.

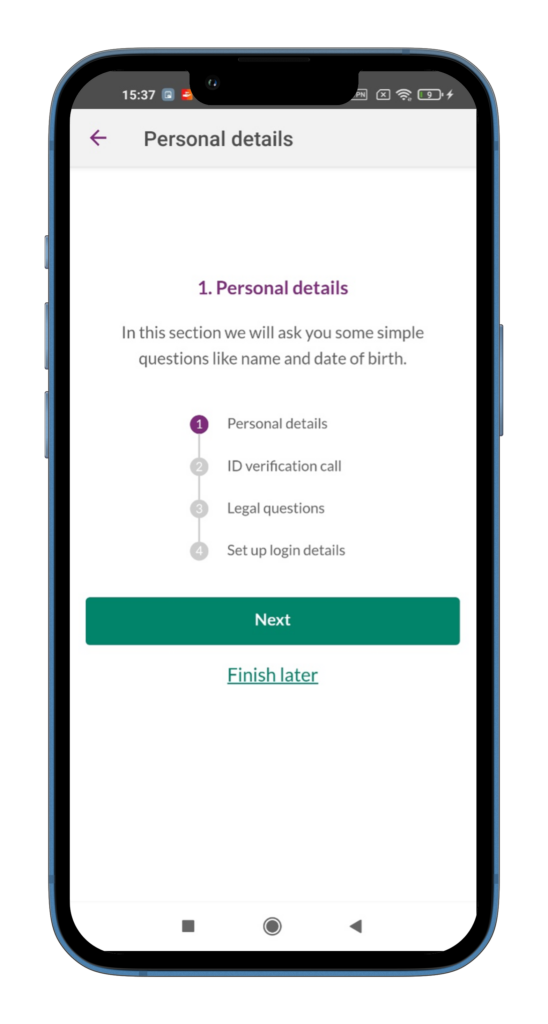

Combining the power of AI with expert-led anti-fraud expertise, VideoIdent was seamlessly integrated into AIB's mobile banking app, enabling customers to securely open an account remotely in under 15 minutes. Once IDnow has completed the remote online identity verification within 5 minutes, a letter is sent to the customer's address to fully complete verification in line with AML and KYC requirements under EU's Anti-Money Laundering Directives (AMLD) and Ireland's Criminal Justice (Money Laundering and Terrorist Financing) Act.

This new process reduced the time taken to open an account from 6 days to 2–3 days.

Architecture & integration

AIB integrated IDnow’s expert-led identity verification solution using a robust technical architecture focused on front-end and back-end integration.

The mobile SDK was embedded into AIB’s Android and iOS apps, ensuring a seamless, user-friendly onboarding flow. On the back-end, REST APIs facilitated secure and scalable data exchange, leveraging widely adopted technologies.

Throughout the integration phase, a dedicated onboarding manager worked closely with AIB’s team, providing hands-on guidance, coordinating technical resources and ensuring a smooth implementation.

Comprehensive support included detailed documentation with implementation guidelines and best practices, a dedicated testing environment and regular consultations.

The solution was successfully integrated in approximately 7 weeks, with AIB experiencing a smooth and efficient process.

Fraud prevention

AIB, like other financial institutions, faces increasingly sophisticated digital threats driven by advancing technology and digitalization. To combat these, VideoIdent provided a comprehensive suite of features, which include:

- Face-comparison feature: Uses AI to match ID photos with user selfies to verify identity.

- Configurable fraud questionnaire: By asking a series of questions to users, social fraud like social engineering and money mules are detected.

- Advanced document verification: Using AI/ML algorithms and visual checks, we verify document authenticity, declared age compliance and thorough fraud prevention.

Thanks to its advanced capabilities, IDnow's expert-led identity verification solution can detect many types of fraud, including identity theft, document forgery, and, unlike automated solutions, social engineering and money mules. In 2024, social fraud accounted for 62% of all attempted fraud captured by IDnow's video solution.

The scaling

As AIB has continued to expand and broaden its online portfolio with new products, such as student accounts and extending eligibility to include non-EEA citizens, IDnow has played a key role in supporting this growth.

With new portfolio offerings boosting the volume of identifications processed by IDnow's expert-led identity verification solution by sevenfold, increasing from approximately 35,000 identifications in 2019 to around 240,000 in 2023, IDnow’s solution has seamlessly scaled alongside AIB’s growing business, ensuring a smooth, secure and efficient verification process to meet rising demand.

“IDnow has enabled us to quickly, yet securely, transform our onboarding process in line with customer expectations.”

Paul Kenny, Digital Product Manager, AIB

Managing peaks

When two competitors exited the Irish market in 2022, AIB experienced a sudden influx of new customers. Leveraging VideoIdent, the bank successfully managed a 142% growth in remote identification volume, increasing from 112,257 in 2023 to 271,936 in 2024 – all without adding any customer waiting time.

Additionally, seasonal peaks, such as the surge in student account openings each September, placed increased demand on AIB's onboarding capacity. Despite student accounts driving a 411% increase in accounts opened remotely, from 2,139 in September 2020 to 10,928 in September 2024, the bank maintained its seamless customer experience, ensuring no delays in the process.

The security & compliance

Regulatory compliance

AIB’s partnership with IDnow ensures full compliance with stringent EU Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations while incorporating state-of-the-art encryption protocols and secure data storage practices to safeguard customer information, ensuring adherence to GDPR and other data protection standards while minimizing risk.

Fraud detection & mitigation

The combination of advanced AI algorithms with expert agent verification enables AIB to detect and mitigate fraud effectively. This hybrid approach continuously monitors and flags high-risk patterns in real time, ensuring speed and accuracy in decision-making, safeguarding both the institution and its customers from fraudulent activities.

Technical support

Dedicated call centers

AIB benefits from a network of IDnow's expert agent call centers strategically located across Europe, including Germany, Romania, and Croatia. This ensures compliance with regional regulations while providing language support tailored to AIB’s diverse customer base.

Support service

AIB benefits from the Enterprise support package, which provides access to a dedicated customer success manager, case trend reporting, and technical support for raising tickets and critical incidents. This ensures AIB receives proactive expert assistance for technical issues, configuration recommendations, and ongoing support to maximize conversion rates and operational efficiency.

Service-level agreements (SLAs)

IDnow guarantees high system reliability, minimizing disruptions to AIB’s operations through clearly defined Service-Level Agreements (SLAs). These agreements stipulate timely support with AIB choosing to have 80% of calls answered within 120 seconds, providing prompt support for technical issues and customer inquiries.